Artificial intelligence and Big Data are applied across all industry sectors. But there is one that has particularly taken advantage of these innovations. It's the financial sector. The financial sector has so thoroughly embraced new technologies that today we speak of Fintech. But what is it about? What is its interest? What are the challenges to be faced? DataScientest responds to all your questions.

What is Fintech?

As a result of the contraction of the words finance and technology, Fintech groups together all the technologies used to improve financial services. The goal then is to simplify this sector, making it more efficient, more secure, and more affordable.

The emergence of new players

Beyond new technologies, the term fintech also refers to startups that use innovations to offer better financial services. And their numbers are growing more and more.

Regarding French companies, we can mention:

- Ulule: to facilitate crowdfunding.

- Ledger: to simplify access to cryptocurrencies.

- Lydia: to facilitate online payments.

- Boursorama banque and Bankin’: two neobanks competing with traditional banks.

- Alan and Luko: next-generation insurance companies.

- Yomoni: an online broker, etc.

Globally, there are also many well-known fintech firms, such as Binance (cryptocurrency), Paypal (online payments), Revolut (online banking), etc.

From cryptocurrency to stock exchanges, through banks and insurance, fintechs now occupy an increasingly significant place in the financial landscape. Even to the point of competing with certain traditional players who are sometimes lagging in adopting information and communication technologies. On the contrary, by relying on these innovations, these startups can offer financial services at a lower cost and of better quality.

A bit of history

The beginnings of Fintech started in the 1950s with the invention of the credit card. But Fintech as we know it today began with the Internet and Big Data.

In particular, it’s since the 2010s that the term has become increasingly popular. Especially after the subprime crisis that impacted traditional financial players. It was time to find alternatives. And that’s where these startups appeared. They then multiplied fundraising efforts to offer more modern services.

What technologies are used?

If fintech aims to revolutionize the world of finance, it is thanks to all the technologies it uses, such as:

- Big Data: by analyzing large volumes of data, they allow startups to better understand their customers,

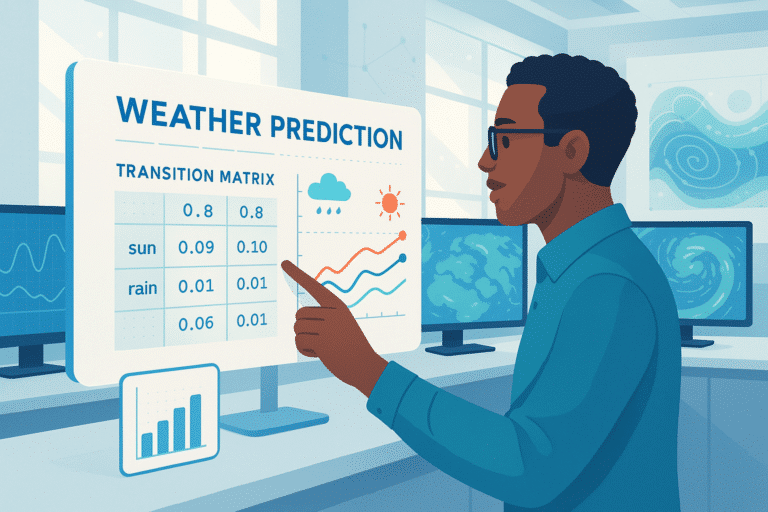

- Artificial intelligence: creating models allows for predictive analysis to anticipate risks but also to provide more personalized customer service (especially with chatbots).

- Biometrics: or e-signatures for a smoother and more secure customer service.

- APIs: to facilitate connections between data, such as financial APIs which allow secure and efficient integrations between financial applications.

- Process automation: the idea is then to improve services while reducing costs.

- Blockchain: this technology improves the storage and transmission of information, making it more secure and transparent. Not to mention that it has enabled the birth of cryptocurrencies, as is the case with Bitcoin.

What activities are involved with Fintech?

As the financial sector is very vast, Fintech can offer a wide variety of services to their customers:

- Banks and insurance: this is where Fintech challenges more traditional players. Yes, these startups propose fees significantly lower than their competitors for similar banking services.

- Robo advisors: these are online financial advisors that also compete with specialized wealth management firms. In this case, the robo advisors rely fully on statistics and data analysis to predict market trends.

- Investments: whether trading platforms or crowdfunding, these startups are giving a new breath to the brokerage profession.

- Cryptocurrencies: these new assets that represent a technological revolution in themselves, Fintech also rides the wave to offer new services (especially with the explosion of intermediary platforms).

- Regtech: ensure the security and compliance of transactions in the banking sector. These startups will, for example, help banks and insurance companies to detect fraud.

What are the challenges of Fintech?

Despite all the advances, Fintechs remain new actors facing multiple challenges:

- Cybercrime: as the services offered by Fintech are based entirely on the Internet and data use, they are particularly exposed to cyber risk.

- Financial stability: some Fintechs specialized in investments (especially trading and crowdfunding) are more exposed to the risk of loss. And if they tend to grow, this could even lead to the catastrophic scenario we have known with the subprime crisis.

- Regulatory constraints: in the face of the emergence of these new players, regulatory bodies are getting more involved. This is the case with the Financial Markets Authority (AMF) which has created a new division “Fintech, innovation, and competitiveness”.

Today, Fintechs are still booming. But to face all the challenges ahead, they need more than ever experts (in data, in cybersecurity, …). So, to integrate into this promising market, start by acquiring the required skills by training. DataScientest is precisely there to help you.