Having already described the digital transformation of the finance function, that of public accounting and auditing firms, in this article we'll attempt to present a concrete example of a real-life situation. The main objective here is to understand how acculturation to a tool like Microsoft Power BI redefines a start-up's budgeting process.

The term “Business Intelligence” first appeared in 1958[1]. It can be defined as “a technological process for analyzing data and presenting information to help (…) business end-users make informed decisions[2]”.

Case Study: The start-up named " BOOSTER"

The start-up “BOOSTER” operates in the logistics sector.

In order to support its finance function in controlling operational activities, particularly with regard to shareholders, digital reporting is envisaged. It should be noted that BOOSTER’s finance function is mainly represented by its CEO, who also assumes the role of CFO. To date, the company has no management control department.

With this in mind, and as an extension to its office suite, the start-up intends to exploit its budget projections via the leading Business Intelligence tool: Microsoft Power BI.

Data sources to consider

The data sources to be exploited and targeted by the stakeholders correspond to the file of accounting entries produced by the entity.

This must be drawn up each month in compliance with the standards codified in article A.47 A-1 of the French tax code. In addition, a flat file dedicated to the budget must be created in line with the entity’s forecasts. This will then be revised during the first half of each accounting year, to constitute a complementary source of data known as the “Forecast”.

This will ultimately correspond to the combination of the following elements:

- actual data (first half-year N).

- data from the revised budget (second half-year N).

The combination of these different data sources should enable us to solve the entity’s main problems.

Structuring your accounting

The notion of “start-up” relates primarily to the notion of innovation.

Indeed, the management of this type of structure focuses its energy on the development of their technology and the corresponding commercial offer.

As a result, accounting can often be likened to the poor relation of internal management, with the choice of tool(s) and/or service provider(s) guided above all by price. With the introduction of Business Intelligence-based reporting, the challenge is to gradually structure accounting. The structural standards set out in article A47 A-1 of the French Tax Procedures Book (Livre des Procédures Fiscales) must be strictly adhered to, for example: “each line of the same entry is therefore assigned a single number” (BOI-CF-IOR-60-40-20, §100).

In addition, the implementation of cost accounting enables management to fine-tune the steering of activities. The aim is to make operations easier to understand, and the decision-making process within the organization more reliable.

The quality of accounting data also makes it possible to respond to the problems of predominantly external financing.

External financing issues

A start-up’s primary ambition is to secure the financing it needs to continue growing.

With this in mind, a number of schemes are available, including:

- Research tax credits (CIR[3]) and innovation tax credits (CII[4])

- Young Innovative Company (JEI[5]) status and related tax exemptions;

- Financial assistance from Bpifrance[6] ;

- Fund-raising with private equity players;

- Products specific to credit institutions (loans, factoring, etc.).

When it comes to these different financing solutions, accountability is paramount. Indeed, to convince potential partners, the deployment of a reporting system ensures regular, high-quality financial communication.

By benefiting from an agile and flexible process, the materialization of controlled steering on the part of the start-up can be proposed to current or potential investors. In addition, the use of a tool such as Microsoft Power BI enables the entity to automate the production of its management indicators. With this in mind, the implementation of specific visuals guarantees informed decision-making on the part of management.

In addition, and in order to rigorously monitor the consumption of the funds made available, the use of budgetary accounting is to be encouraged.

Controlling your budget

Budgetary accounting meets several needs at the start-up BOOSTER.

The need to set targets can compensate for the absence of actual or irregularly recorded cash flows. Based on past events in particular, the entity is able to construct an annual budget to estimate its operating requirements. The implementation of a strategy should also be taken into account when projecting estimates. In the context of transparent financial communication, particularly in the case of external financing, mastery of budget assumptions is essential to the credibility of the organization and its management.

Furthermore, the ability to measure any discrepancies between actual and forecast performance enables the organization to react accordingly.

In effect, the overall strategy adapts to any discrepancies in the achievement of objectives. Any difference in the entity’s favor represents a “safety margin” in its operations, enabling it to activate additional development actions if necessary.

On the other hand, any over- or under-performance in relation to the budget necessitates the revision of certain projections, in order to adjust forecast consumption, among other things.

Thanks to its ability to handle a multitude of data sources, Microsoft Power BI is compatible with the use of files built as part of a budgeting process.

Income statement projections

The construction of an initial budget for the start-up will then enable a revised version to be generated to enhance financial management.

Indeed, BOOSTER’s finance function wishes to visualize the income statement through three sources of data: general accounting, the budget and the revised budget. The revised budget is drawn up by the finance function during the first half of each current financial year. Based on updated estimation assumptions, this source takes the form of a forecast comprising the following elements:

- The first six months of the current year, based on accounting flows;

- The last six months of the current year, based on the revised N budget.

As a result, BOOSTER’s income statement can be projected using different scenarios: actual, budget, forecast. Comparisons can then be made, particularly with regard to the year-end landing. By extension, the entity’s management can be continued over time by regularly updating forecasts. To this end, Microsoft Power BI can handle different versions of a budget if it is modified several times during the year:

The next step is to help the start-up keep track of its cash consumption.

Cash flow monitoring

A start-up’s development ambitions often lead it to seek financing from external players.

Depending on its level of maturity, a start-up may need to position itself in a series of different fund-raising rounds.

Once equity has been built up and any seed capital loans taken out, the start-up may first aim for a first phase called “Series A“, designed to develop the product and the target.

This first round of financing enables the company to raise funds from venture capitalists in particular. Subsequently, the start-up can call on additional rounds to continue its growth.

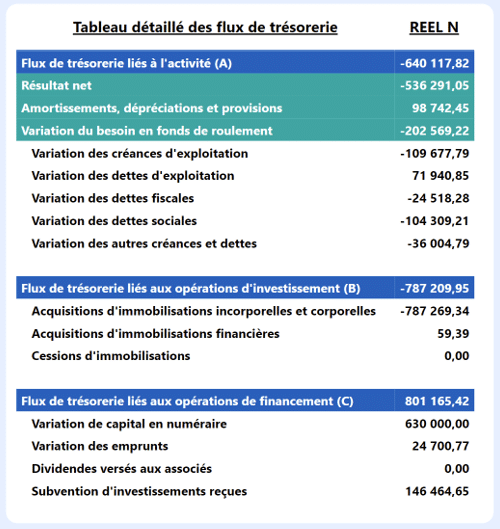

Once the funds have been raised, the responsible use of available resources can be documented. By extension, a reporting system can also be set up to support the next round of capital raising. This can provide a visualization of cash flows broken down into the various consumption items: activity, investment, financing.

Mictosoft Power BI is therefore an asset of choice for the finance function, both for reporting to investors and for internal steering. It can thus be used as a genuine financial communication tool, guaranteeing true transparency for stakeholders:

Ultimately, it’s a matter of materializing the differences between actual and budget.

Identifying discrepancies between actual and budget

Using Business Intelligence, reporting should be geared to detecting any slippage in the entity’s consumption or performance.

As an extension of the budget construction defined above, deviations from actual flows can be identified by analytical axis. By way of example, the discrepancies between the start-up’s sales and budget targets are broken down by activity in the figure below:

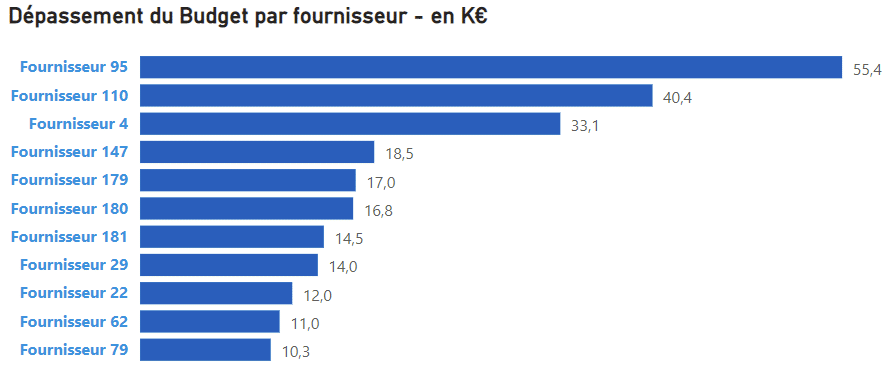

In even finer detail, the positioning of BOOSTER’s actual flows in relation to its budget can be materialized beyond the analytical axis. Indeed, the consumption of operating expenses can be broken down by supplier in the figure below:

Following on from previous developments, the finance function now has a modern reporting system that addresses the main issues facing start-ups.

Conclusion

In this article, we presented the context of start-up BOOSTER and its budget projections.

The main issues specific to start-ups were addressed here. Microsoft Power BI is an invaluable tool for finance, providing a continuous economic view of operations and enabling corrective action to be taken, while at the same time playing an active role in structuring the accounting system.

The visuals created enable start-up BOOSTER to monitor its performance from an economic viewpoint. In fact, the various data flows are broken down by activity and by major expenditure items.

In addition, monitoring of cash consumption enables the management of funds entrusted to BOOSTER to be reflected in the reporting, in full transparency to stakeholders. Finally, the achievement of budget targets is also monitored by automatic calculation of deviations from actual performance.

Notes

- LUHN H. P., (1958), A Business Intelligence System, IBM Journal, Vol. 2, p. 314-319.